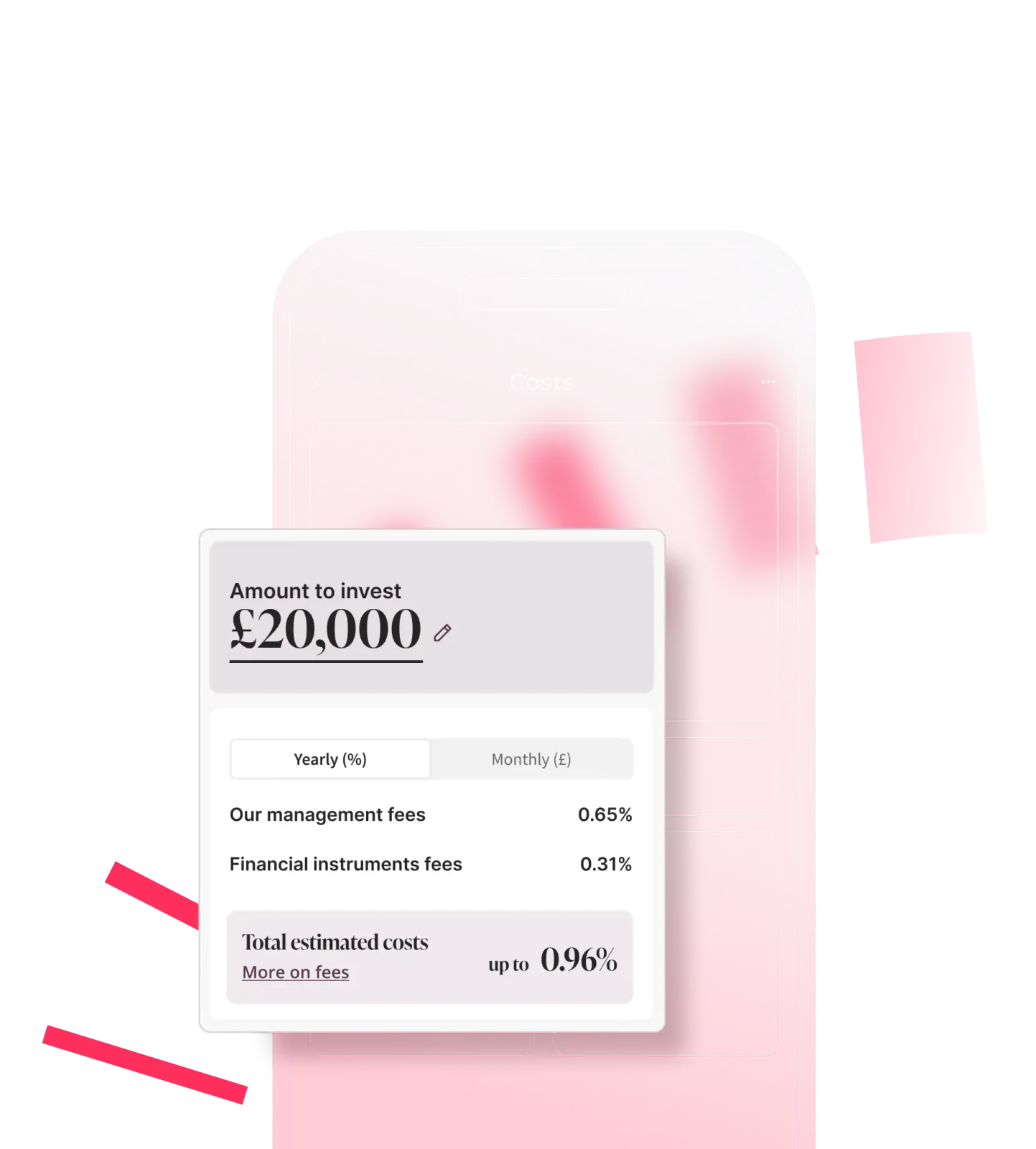

Invest with confidence, knowing exactly what you’re paying.

Everything we offer comes with simple, transparent pricing. We’re committed to keeping your costs as low as possible, with no hidden fees.

Investments can go down in value as well as up, and you may get back less than you put in.