Thematic Investing.

Take your investing to the next level. Add Moneyfarm’s growth themes to your portfolio to invest in the megatrends shaping our world and your financial future.

Get started

Thematic Investing.

Take your investing to the next level. Add Moneyfarm’s growth themes to your portfolio to invest in the megatrends shaping our world and your financial future.

Get startedWhat is Thematic Investing?

Thematic investing is a future-focused approach that centres on powerful global trends reshaping industries and economies. From technological innovation to climate solutions and societal changes, this strategy allows you to invest in areas driving the future.

By adding Moneyfarm’s expertly-built growth themes to your portfolio, you can align your investments with these megatrends, diversifying your investments while targeting long-term growth opportunities. You get more choice over how your money is invested, allowing you to build a risk-managed portfolio that is more aligned with your preferences, goals and values.

With Moneyfarm you also get access to ETFs from some of the best fund managers in the world, so you can feel confident you’re values and financial goals are aligned.

Is thematic investing right for you?

Invest in high-growth areas

With Moneyfarm growth themes, you can gain exposure to the innovations, stories and megatrends shaping our future.

Match your risk level

Stay confident knowing that your portfolio’s investments are balanced with your selected themes and you maintain a level of risk that is right for you.

Personalise your portfolio

Your portfolio can focus on growth areas and reflect your interests or values, such as sustainability or technology.

With Moneyfarm growth themes, you can gain exposure to the innovations, stories and megatrends shaping our future.

Stay confident knowing that your portfolio’s investments are balanced with your selected themes and you maintain a level of risk that is right for you.

Your portfolio can focus on growth areas and reflect your interests or values, such as sustainability or technology.

Access ETFs from

some of the biggest

names in the industry.

Access ETFs from some of the biggest names in the industry.

Our growth themes.

Our growth themes.

Help secure a more sustainable world for future generations. Invest in sectors including:

- Circular economy

- Clean energy

- Blue economy

- Clean water

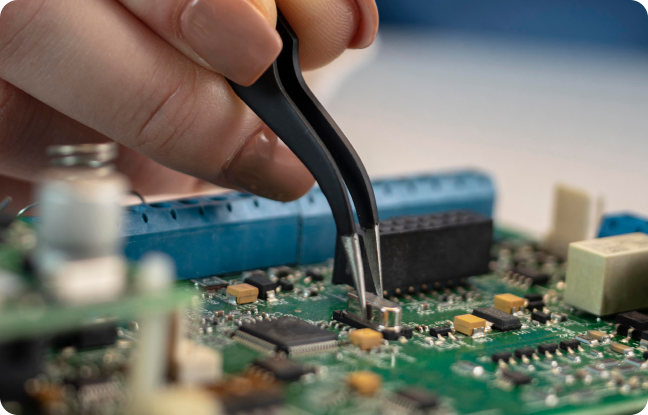

Target breakthrough technology and disruptive innovation. Invest in sectors including:

- Semiconductors

- E-commerce

- Electric vehicles

- Clean energy

- Artificial intelligence

Focus on the impact of changes in society and our shifting demographics. Invest in sectors including:

- E-commerce

- E-sports

- Global infrastructure

- Gender equality

The earlier you start investing for your child, the more time you give their wealth to grow. Our JISA has a £9,000 tax free allowance each year and sustainable portfolio options.

- E-commerce

- Semiconductors

- Global infrastructure

- Circular economy

Diversify your thematic investing across all Moneyfarm growth themes. Invest in sectors including:

- Semiconductors

- E-commerce

- Electric vehicles

- Clean energy

- Artificial intelligence

Competitive, transparent pricing.

Competitive, transparent pricing.

If you invest £15,000 in an active managed globally diversified portfolio with themes, you’ll pay:

If you invest £15,000 in an active managed globally diversified portfolio with themes, you’ll pay:

| Fee | Annual % | Annual % |

|---|---|---|

| Moneyfarm fee | 0.70% | £105.00 |

| Underlying fund fee (weighted average between core/satellite thematics funds) | Up to 0.26% | £39.00 |

| Market spread* | 0.10% | £15.00 |

| Total | 1.05% | £159.00 |

| Fee | Annual % | Annual % |

|---|---|---|

| Moneyfarm fee | 0.70% | £105.00 |

| Underlying fund fee (weighted average between core/satellite thematics funds) | Up to 0.26% | £39.00 |

| Market spread* | 0.10% | £15.00 |

| Total | 1.05% | £159.00 |

The example above is based on an investment of £15,000 (learn more about the fees and costs for active management).

*The market spread effect also impacts your investments. This is a characteristic of trading on the financial markets and represents the difference between bid and ask (buying and selling) prices for an investment at a specific time. This can be 0.10% at Moneyfarm (assuming the average between our Classic and ESG allocations, we sell 40% of the assets in your portfolio and replace them with new assets during the year), but you'll always see the real price you buy and sell assets at.

Getting started is easy.

Answer a few simple questions

Discover your perfect portfolio

Invest according to your goals

Answer a few simple questions

Discover your perfect portfolio

Invest according to your goals