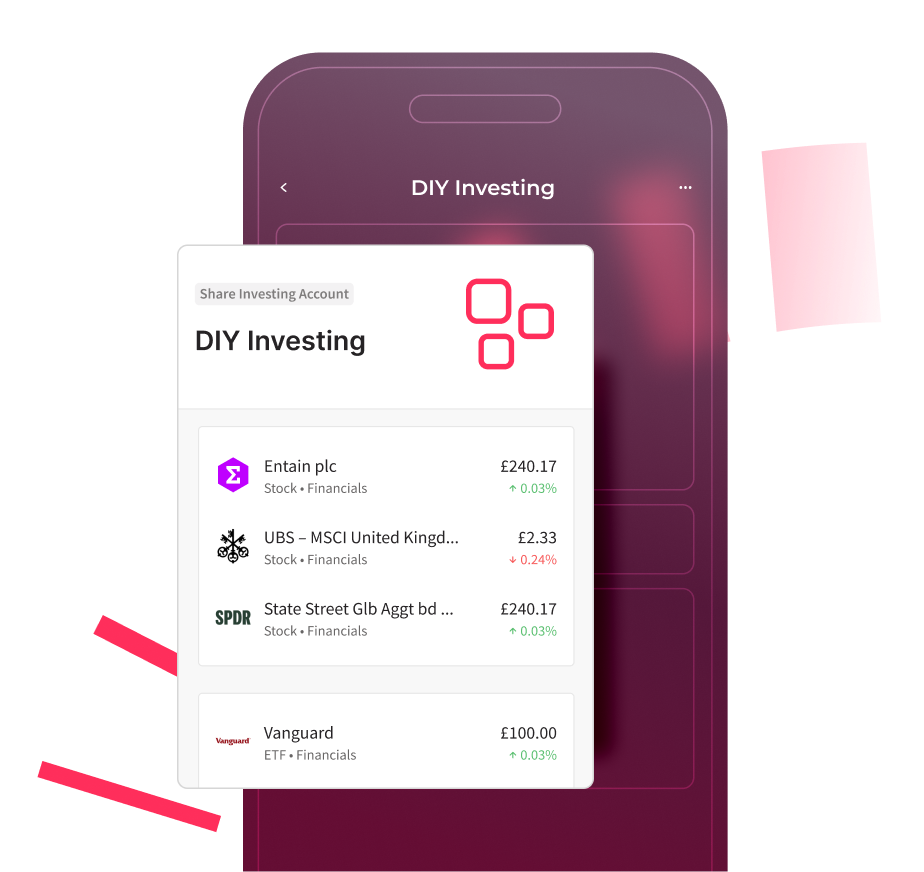

DIY Investing: Your strategy, our expertise.

Build a portfolio that’s uniquely yours, backed by our expert guidance and comprehensive market insights – all in one user-friendly platform.

DIY Investing: Your strategy, our expertise.

Build a portfolio that’s uniquely yours, backed by our expert guidance and comprehensive market insights – all in one user-friendly platform.

Build your portfolioTransfer a portfolioWhat you get with DIY Investing.

Direct market access

Access a diverse investment universe of 1,000+ individual stocks, ETFs, bonds, and mutual funds.

One home for all your investments

Build your own diverse portfolio or invest alongside our expertly managed, globally diversified options to take full advantage of our expertise.

Personalised strategy

Build a portfolio that truly reflects your values and wealth goals. Shape your investment journey, one carefully chosen asset at a time.

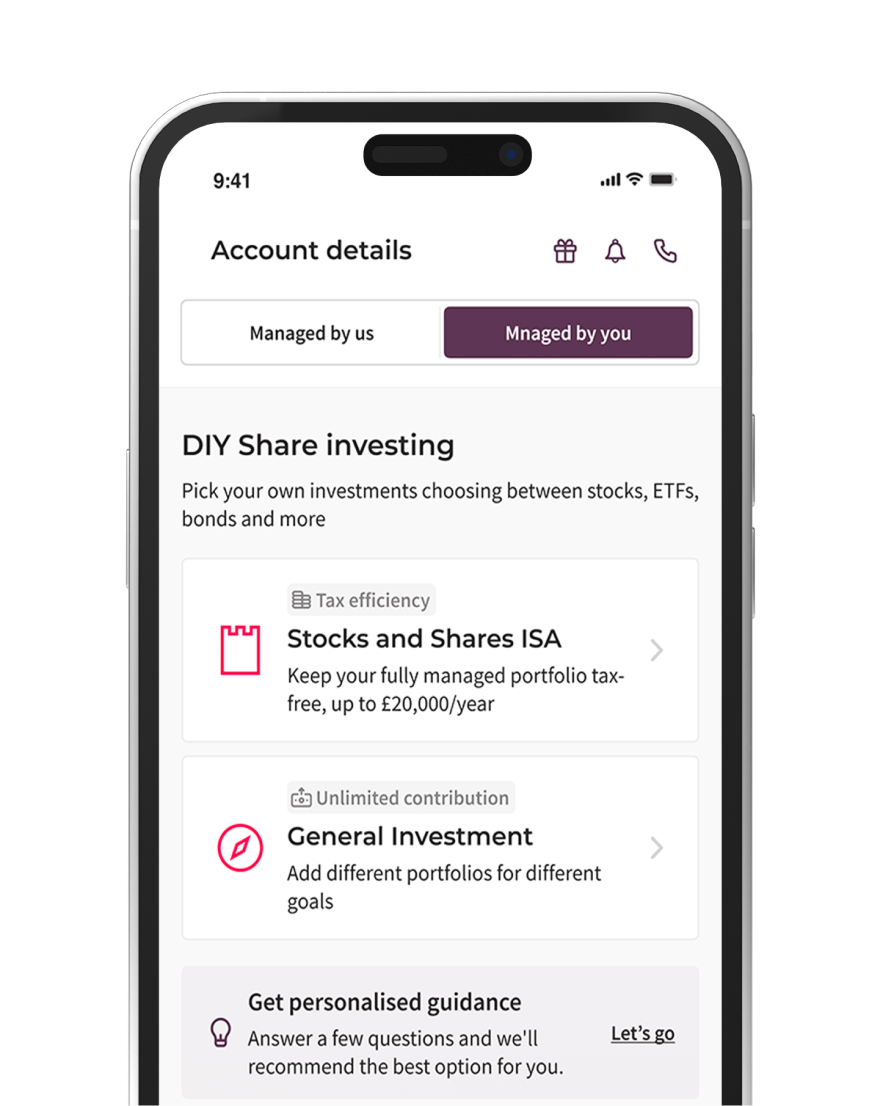

How do you want to invest?

How do you want to invest?

- Tax-efficient:

Grow your investments free from Income Tax and Capital Gains Tax - Annual allowance:

Invest up to £20,000 per tax year (2024/25) - Flexible withdrawals:

Access your money when you need it, without losing your allowance - Long-term growth:

Ideal for building tax-free wealth over time

- Tax-efficient:

- Grow your investments free from Income Tax and Capital Gains Tax

- Annual allowance:

- Invest up to £20,000 per tax year (2024/25)

- Flexible withdrawals:

- Access your money when you need it, without losing your allowance

- Long-term growth:

- Ideal for building tax-free wealth over time

- Unlimited investments:

No caps on how much you can invest annually - Flexible deposits and withdrawals:

Add or remove funds at any time, free from penalties - Complementary to ISAs:

Invest beyond your ISA allowance - Capital Gains Tax applies:

Be aware of potential tax on investment gains

Pricing.

Management fees

Other fees

If you have an ISA account, a yearly custody fee of just 0.35% applies (capped at £45 a year).

ETFs and Stocks listed on the London Stock Exchange

In addition to the amounts due to us (order fee) for the provision of our Share Investing Services, you will be charged for payment of the following costs in case of trading of ETFs and Stocks listed on the London Stock Exchange:

-Stamp Duty is a tax that is charged on the purchase of shares in the UK. The rate of Stamp Duty is 0.5% of the purchase price of the shares

-PTM (Panel of Takeovers and Mergers) is a £1 government levy that is automatically charged to investors when they buy or sell shares for over £10,000.

Foreign Stocks

If held within an ISA, there will be no UK Capital Gains Tax or income tax on the proceeds from foreign stocks. Your only tax loss will be any withholding tax (WHT) deducted at source in the country where the stock is listed. As such, there is no exemption from WHT by using an ISA.

Ongoing charges for funds

Ongoing charges are the annual costs of owning an investment fund, such as an ETF or mutual fund. They are expressed as a percentage of the fund’s assets and are deducted from the fund’s net asset value (NAV) on a daily basis.

Cost breakdown:

| Scenario | Fee type | Fee | Cost £ |

|---|---|---|---|

| £15,000 traded in one single stock | Trade fee | £3.95 per trade | £3.95 |

| If deposited in an ISA | Custody fee | 0.35% capped at £45 | £45.00 |

| If trade is in foreign currency | Currency conversions fee | 0.70% | £105.00 |

| Total management fees | £153.95 | ||

| Taxes | |||

| If trading shares | Stamp duty | 0.50% | £75 |

| If trading over £10,000 | PTM tax | £1 | £1 |

| Total (fees and taxes) | £229.95 |

| Scenario | Fee type | Fee | Cost £ |

|---|---|---|---|

| £15,000 traded in one single stock | Trade fee | £3.95 per trade | £3.95 |

| If deposited in an ISA | Custody fee | 0.35% capped at £45 | £45.00 |

| If trade is in foreign currency | Currency conversions fee | 0.70% | £105.00 |

| Total management fees | £153.95 | ||

| Taxes | |||

| If trading shares | Stamp duty | 0.50% | £75 |

| If trading over £10,000 | PTM tax | £1 | £1 |

| Total (fees and taxes) | £229.95 |

Get the support you need.

Our UK-based client service team is on hand to help you with transactions, queries or anything else to do with your account. We're here to support and help you, whenever you need us.

Discover moreDiscover more

What can you invest in?

Our Managed ISA can be personalised with different investment styles to align with your values and goals.

Stocks

Invest in a wide array of companies across various sectors and markets. Build a portfolio that aligns with your financial goals and risk tolerance, whether you’re seeking growth, income, or a balance of both.

Bonds

Diversify your portfolio with bonds, offering stability and a regular income stream through fixed-interest payments. Choose from a range of government and corporate bonds to tailor your investment strategy and manage risk.

ETFs

Immerse yourself in the dynamic world of ETFs. These versatile investment instruments can help diversify your portfolio efficiently, giving you exposure to entire markets, sectors, or asset classes in a single trade.

Mutual funds

Broaden your investment reach with our selection of mutual funds. Access professionally managed portfolios that provide exposure to a diverse array of markets and strategies, enabling a balanced and diversified investment approach.

Invest in a wide array of companies across various sectors and markets. Build a portfolio that aligns with your financial goals and risk tolerance, whether you’re seeking growth, income, or a balance of both.

Diversify your portfolio with bonds, offering stability and a regular income stream through fixed-interest payments. Choose from a range of government and corporate bonds to tailor your investment strategy and manage risk.

Immerse yourself in the dynamic world of ETFs. These versatile investment instruments can help diversify your portfolio efficiently, giving you exposure to entire markets, sectors, or asset classes in a single trade.

Broaden your investment reach with our selection of mutual funds. Access professionally managed portfolios that provide exposure to a diverse array of markets and strategies, enabling a balanced and diversified investment approach.

Get started in 3 simple steps.

On your own or with help from one of our consultants.

Choose to invest your own way and let our questionnaire guide you.

Select your account type: Stocks and Shares ISA or General Investment Account – and fill in your details.

Start building your portfolio with access to our research tools and expert insights.

Choose to invest your own way and let our questionnaire guide you.

Select your account type: Stocks and Shares ISA or General Investment Account – and fill in your details.

Start building your portfolio with access to our research tools and expert insights.