Build your wealth with confidence, guided by experts.

Our accessible approach to investing, with ready-made portfolios or the option to choose your own investments, means Moneyfarm could be the best place to invest your money.

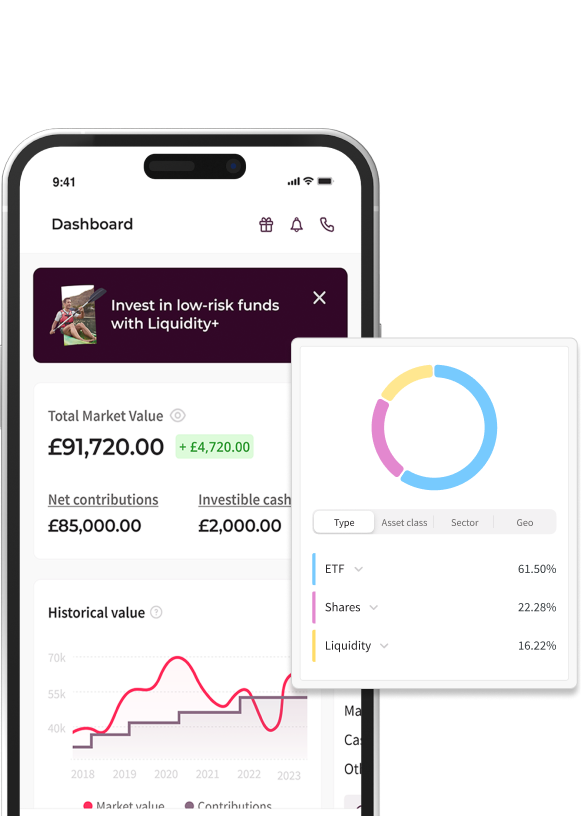

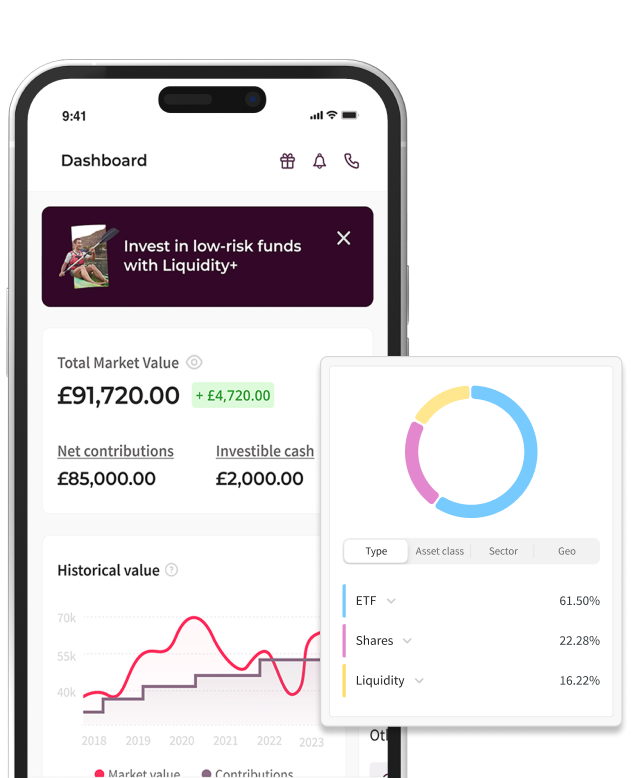

Let's get startedThe image is for illustrative purposes only and is not representative of any client's portfolio.

Build your wealth with confidence, guided by experts.

Our accessible approach to investing, with ready-made portfolios or the option to choose your own investments, means Moneyfarm could be the best place to invest your money.

Let's get started

Invest in an expertly managed portfolio.

Our investment experts build and manage your portfolio, giving your wealth the best chance to grow.

Whether it’s an ISA, Pension or General Investment Account (GIA), we match your portfolio to your goals and risk profile, taking care of all the work for you.

Invest your own way.

Build your own portfolio on our Share Investing platform. Choose your own investments from a wide range of stocks, ETFs, bonds and mutual funds.

Enjoy the freedom to shape your strategy, backed by our team’s market insights and experience.

Invest in an expertly managed portfolio.

Our investment experts build and manage your portfolio, giving your wealth the best chance to grow.

Whether it’s an ISA, Pension or General Investment Account (GIA), we match your portfolio to your goals and risk profile, taking care of all the work for you.

Let's get started

Invest your own way.

Build your own portfolio on our Share Investing platform. Choose your own investments from a wide range of stocks, ETFs, bonds and mutual funds.

Enjoy the freedom to shape your strategy, backed by our team’s market insights and experience.

Create your portfolio

Choose what to invest in.

Whether you're saving for retirement, your child’s future, or just looking to grow your wealth, we offer a range of accounts tailored to your needs. From ISAs to Pensions, find the portfolio that fits your goals. Not sure which account is right for you?

Stocks & Shares ISA

Ensure you won't lose valuable guarantees like annuity rates, guaranteed income, or death benefits. Seek financial advice if unsure.

Tell me more about the Stocks & Shares ISACash ISA

Enjoy tax-free growth, daily interest, flexible access, and no fees. All with the security of FSCS protection up to £85,000.

Tell me more about the Cash ISAJunior ISA

Ensure you won't lose valuable guarantees like annuity rates, guaranteed income, or death benefits. Seek financial advice if unsure.

Tell me more about the Junior ISAPension (SIPP)

Planning for your financial future?

Take control with a Self-Invested Personal Pension.

GIA

Maxed out your ISA for the year? Grow your wealth with a flexible General Investment Account and expertly managed portfolios.

Tell me more about the GIAEnsure you won't lose valuable guarantees like annuity rates, guaranteed income, or death benefits. Seek financial advice if unsure.

Tell me more about the Stocks & Shares ISAEnjoy tax-free growth, daily interest, flexible access, and no fees. All with the security of FSCS protection up to £85,000.

Tell me more about the Cash ISAEnsure you won't lose valuable guarantees like annuity rates, guaranteed income, or death benefits. Seek financial advice if unsure.

Tell me more about the Junior ISAPlanning for your financial future? Take control with a Self-Invested Personal Pension.

Tell me more about the SIPPMaxed out your ISA for the year? Grow your wealth with a flexible General Investment Account and expertly managed portfolios.

Tell me more about the GIATake the next step with us

When you invest with us, we're in it together - you're backed by a team dedicated to helping you achieve your investment goals and turning your aspirations into a reality. So, take the first step towards financial freedom and let us be your guide.

Let's get startedLet's get startedOne straightforward fee.

As your money grows we’ll lower your fees. That’s investing that gives you more

What you’ll pay

Total estimated costs

As your wealth grows, the Moneyfarm fee can reduce to 0.35%.

More on fees