Managed Stocks and Shares ISA.

Unlock the full potential of your wealth with a Managed Stocks & Shares ISA. Our investment experts manage and monitor your investments, giving your wealth the best chance to grow.

Managed Stocks and Shares ISA.

Unlock the full potential of your wealth with a Managed Stocks & Shares ISA. Our investment experts manage and monitor your investments, giving your wealth the best chance to grow.

Open your ISATransfer ISAMatch your investments to your values and goals.

Matched to you

A globally diversified portfolio matched to your goals and personal risk profile, backed by smart technology and human expertise.

Expert portfolio maintenance

Our Asset Allocation team monitors and regularly rebalances your ISA to maintain its optimal structure.

Comprehensive risk management

Your ISA portfolio stays aligned with your personal risk profile and investment goals.

Advanced market insights

Cutting-edge technology drives in-depth analysis for strategic investment decisions.

Stay informed

Open communication keeps you engaged and in the loop about your ISA investments.

Match your investments to your values and goals.

A globally diversified portfolio matched to your goals and personal risk profile, backed by smart technology and human expertise.

Our Asset Allocation team monitors and regularly rebalances your ISA to maintain its optimal structure.

Your ISA portfolio stays aligned with your personal risk profile and investment goals.

Cutting-edge technology drives in-depth analysis for strategic investment decisions.

Open communication keeps you engaged and in the loop about your ISA investments.

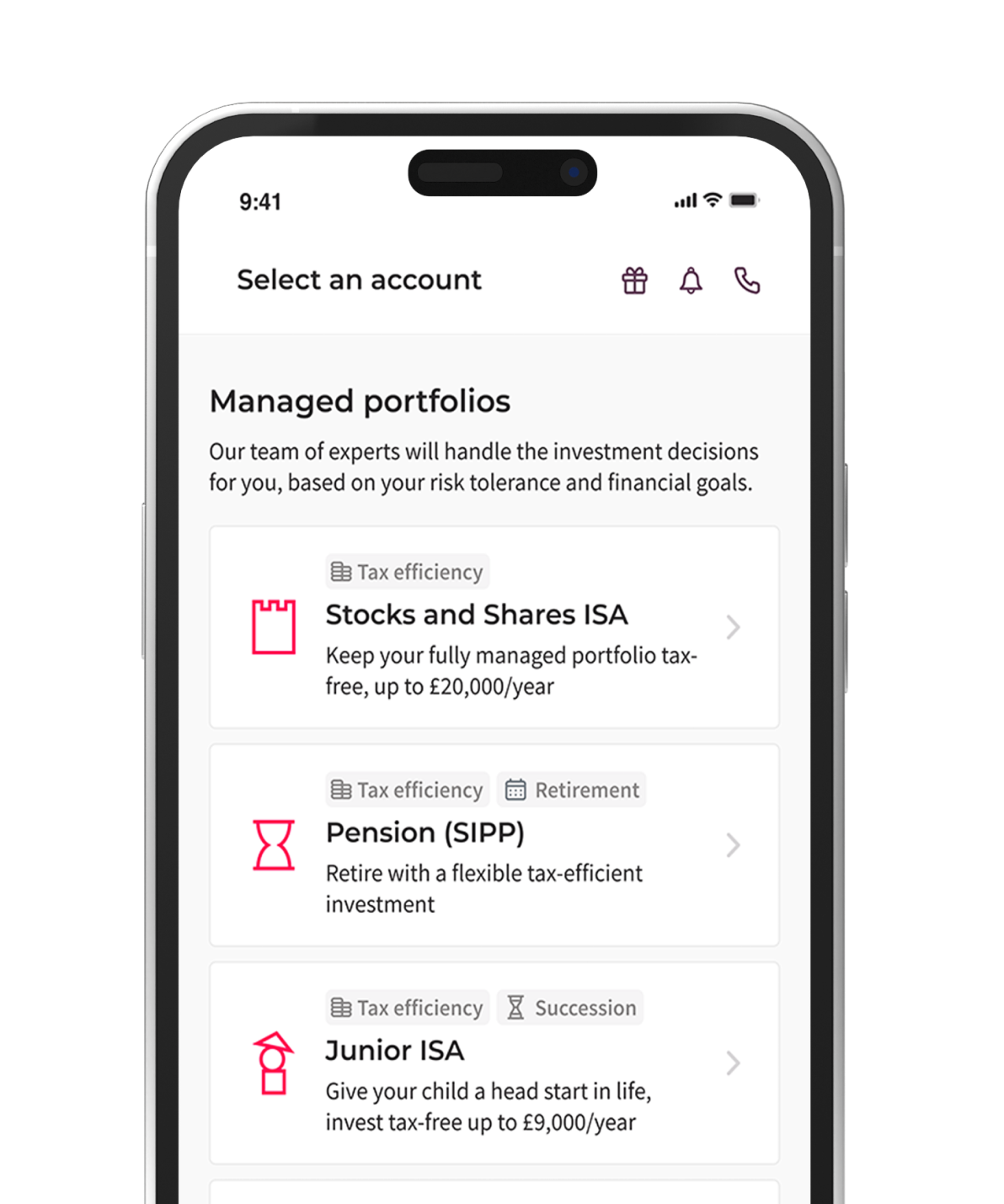

A Managed ISA could be right for you if…

You’re looking for a ready-made portfolio that aligns with your goals.

You want Moneyfarm’s experts to manage your investments.

You aim to build your wealth while maintaining tax benefits.

You prefer a hands-off, time-saving approach to investing.

Is a Managed ISA right for you?

Our Managed ISA can be personalised with different investment styles to align with your values and goals.

Socially responsible investing (ESG)

Choose a diversified portfolio with a mix of assets that meet environmental, social, and governance (ESG) sustainability requirements.

Learn more ❯

Money market funds (Liquidity+)

Make your short-term cash work harder with a low-risk portfolio, a Bank of England variable rate, plus flexible access.

Thematic Investing

Add megatrend themes to your portfolio and gain exposure to the high-growth areas changing our world.

Choose a diversified portfolio with a mix of assets that meet environmental, social, and governance (ESG) sustainability requirements.

Learn more ❯

Make your short-term cash work harder with a low-risk portfolio, a Bank of England variable rate, plus flexible access.

Learn more ❯

Add megatrend themes to your portfolio and gain exposure to the high-growth areas changing our world.

Learn more ❯

Guidance that grows with you.

From digital advice to one-to-one support with a Dedicated Qualified Wealth Manager, our Wealth tiers are designed to give you the right level of guidance as your investment needs grow.

Discover the Wealth tiersDiscover the Wealth tiers

What our clients say about us.

Trust is earned, not given. If you’re still unsure about Moneyfarm, discover what our clients are saying about us on Trustpilot.

How our pricing works.

Choose an investment style and compare the fees.

Management fees are charged on your invested amount. You’ll also incur average fund costs (around 0.16% per year) and market spread effects (up to 0.05% per year).

Platform fee

(Min £1.25/month)

The platform fee applies to all Wealth assets combined. VAT included where applicable.

Calculate my feesHow do they perform?

How do they perform?

Explore the performance of our portfolios over time. View overall trends and the performance for specific years.

Explore the performance of our portfolios over time. View overall trends and the performance for specific years.

Key to the figures

Moneyfarm returns net of fees since inception (01/01/2016) vs. average peer group performance over the same time period. These past performance figures are simulated. Past performance is no indicator of future performance. The allocations shown above are based on our model portfolios at a point in time, so they’re an illustration of how your actual portfolio might look. The exact composition may differ, if the value of your portfolio falls below c. £3,000.

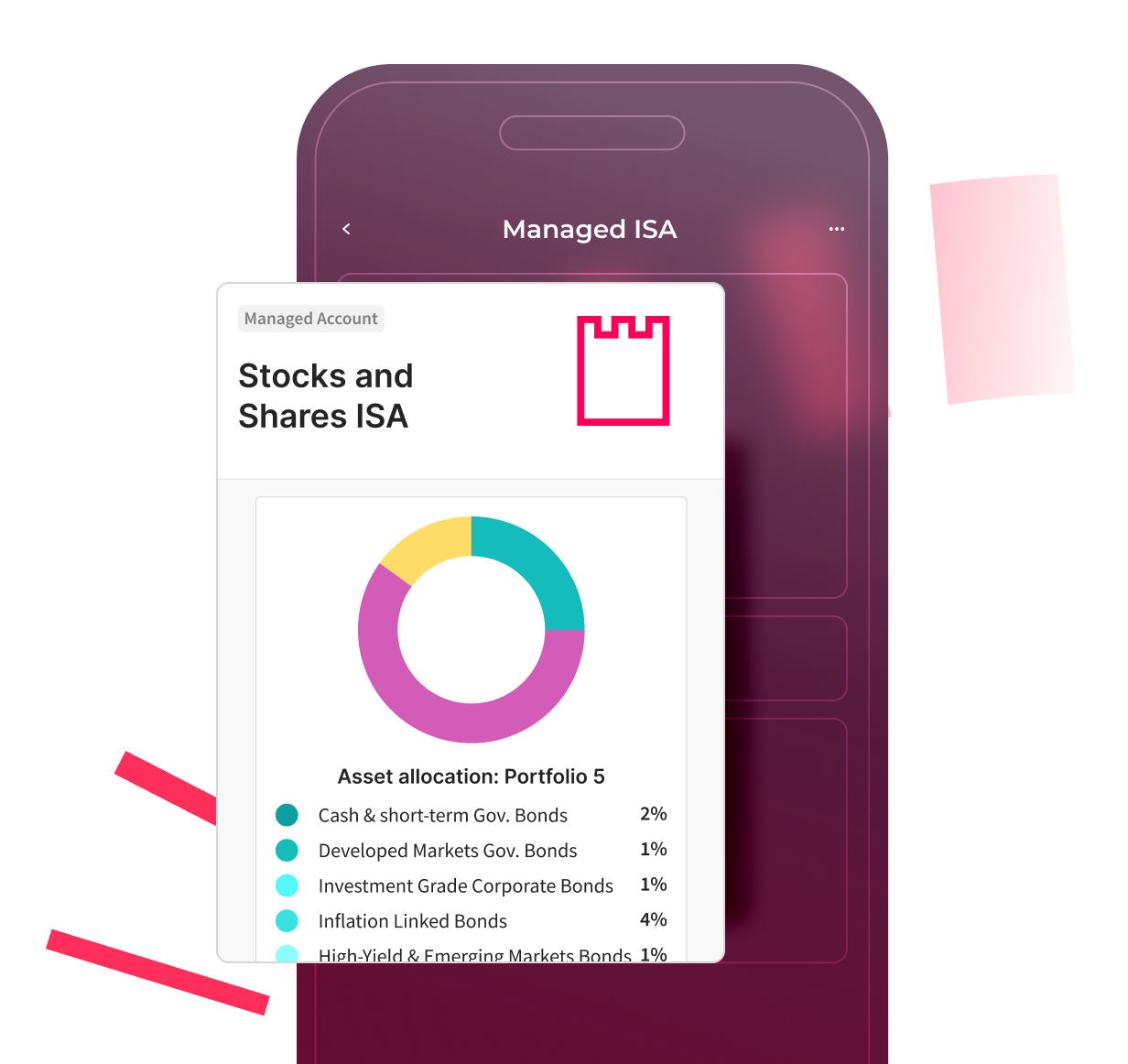

What we invest in.

What we invest in.

Explore the full asset breakdown of our seven portfolios – from lower risk to higher risk – by asset type, sector and geography. Use the toggle to switch between Classic and ESG portfolio types.

With our Thematic Investing option, you can add growth themes to your portfolio to invest in megatrends like technological innovation, sustainability and changes in society.

Explore the full asset breakdown of our seven portfolios – from lower risk to higher risk – by asset type, sector and geography. Use the toggle to switch between Classic and ESG portfolio types.

With our Thematic Investing option, you can add growth themes to your portfolio to invest in megatrends like technological innovation, sustainability and changes in society.

Discover the untapped potential of your wealth when you invest with us.

Discover the untapped potential of your wealth when you invest with us.

Simply input how much you’re thinking of investing initially, how much you might contribute regularly, and for how long.

Simply input how much you’re thinking of investing initially, how much you might contribute regularly, and for how long.

Loading...

Get started in 3 simple steps.

On your own or with help from one of our consultants.

Choose an investment solution or let our questionnaire guide you.

Discover the option best suited to your objectives and needs.

Start your investing journey with our experts by your side.

Choose an investment solution or let our questionnaire guide you.

Discover the option best suited to your objectives and needs.

Start your investing journey with our experts by your side.