Unlock your wealth potential with our General Investment Account.

Professional management, personalised investment strategies, and expert consultants by your side.

Get started

Unlock your wealth potential with our General Investment Account.

Professional management, personalised investment strategies, and expert consultants by your side.

Get startedEnjoy limitless investing, your way.

Discover the key benefits of our General Investment Account:

Unlimited investment potential

No caps on how much you can invest.

Flexible portfolio options

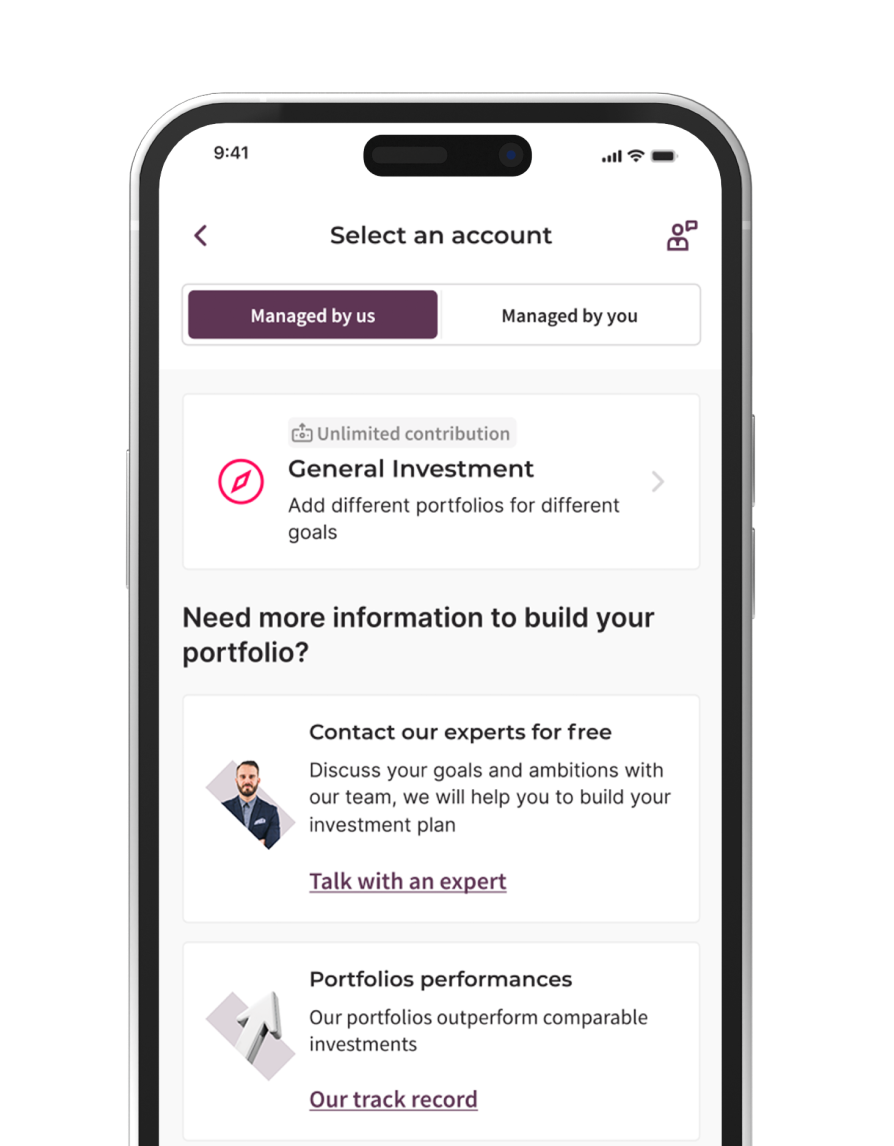

Choose a Managed GIA to benefit fully from our expertise, or build and manage your own portfolio with a DIY GIA.

Enjoy limitless investing, your way.

Discover the key benefits of our General Investment Account:

No caps on how much you can invest.

Choose a Managed GIA to benefit fully from our expertise, or build and manage your own portfolio with a DIY GIA.

All your pension wealth under one roof.

You’ve used up your tax-free ISA allowance and want to invest without limits.

You’re comfortable to invest subject to tax on any gains above your tax-free allowance.

You want the choice and flexibility to build your own portfolio

A General Investment Account to suit you.

Choose a Managed GIA if you want our experts to guide you through the portfolio creation process and manage your investments for you. Choose a DIY GIA if you want to choose your own investments and self-manage your portfolio.

A General Investment Account to suit you.

Choose a Managed GIA if you want our experts to guide you through the portfolio creation process and manage your investments for you. Choose a DIY GIA if you want to choose your own investments and self-manage your portfolio.

- Matched to you

Get matched with an expertly built, fully managed, ready-to-go portfolio. Or for a simpler, low-cost approach, choose a fixed allocation portfolio. - Enhanced strategies

Level up your Moneyfarm experience with different investing strategies – ESG, Thematic Investing, or Liquidity+, our smart, short-term investment solution. - Experts at your side

Our dedicated consultants are available at your disposal, ensuring you achieve your investment goals with confidence. - Transparent pricing

Enjoy simple, clear and transparent fees. Set up your portfolio for free. Learn more

- Direct market access

Choose from 1,000+ assets including stocks, ETFs, bonds, and mutual funds. - Guided investment experience

Shape your strategy backed by our team’s market insights and experience. Discover investment themes with our curated asset collections. - Personalise your portfolio

Create a portfolio in line with your values and goals, one investment at a time. All with a comprehensive view of your investments for effective decision-making. - Free to open an account

Set up your DIY GIA portfolio for free and get started in no time.

Guidance that grows with you.

From digital advice to one-to-one support with a Dedicated Qualified Wealth Manager, our Wealth tiers are designed to give you the right level of guidance as your investment needs grow.

Discover the Wealth tiersDiscover the Wealth tiers

What our clients say about us.

Trust is earned, not given. If you’re still unsure about Moneyfarm, discover what our clients are saying about us on Trustpilot.

How our pricing works.

Choose an investment style and compare the fees.

Management fees are charged on your invested amount. You’ll also incur average fund costs (around 0.16% per year) and market spread effects (up to 0.05% per year).

Platform fee

(Min £1.25/month)

The platform fee applies to all Wealth assets combined. VAT included where applicable.

Calculate my feesHow do they perform?

How do they perform?

Explore the performance of our portfolios over time. View overall trends and the performance for specific years.

Explore the performance of our portfolios over time. View overall trends and the performance for specific years.

Key to the figures

Moneyfarm returns net of fees since inception (01/01/2016) vs. average peer group performance over the same time period. These past performance figures are simulated. Past performance is no indicator of future performance. The allocations shown above are based on our model portfolios at a point in time, so they’re an illustration of how your actual portfolio might look. The exact composition may differ, if the value of your portfolio falls below c. £3,000.

What we invest in.

What we invest in.

Explore the full asset breakdown of our seven portfolios – from lower risk to higher risk – by asset type, sector and geography. Use the toggle to switch between Classic and ESG portfolio types.

With our Thematic Investing option, you can add growth themes to your portfolio to invest in megatrends like technological innovation, sustainability and changes in society.

Explore the full asset breakdown of our seven portfolios – from lower risk to higher risk – by asset type, sector and geography. Use the toggle to switch between Classic and ESG portfolio types.

With our Thematic Investing option, you can add growth themes to your portfolio to invest in megatrends like technological innovation, sustainability and changes in society.

Discover the untapped potential of your wealth when you invest with us.

Discover the untapped potential of your wealth when you invest with us.

Simply input how much you’re thinking of investing initially, how much you might contribute regularly, and for how long.

Simply input how much you’re thinking of investing initially, how much you might contribute regularly, and for how long.

Loading...

Get started in 3 simple steps.

On your own or with help from one of our consultants.

Choose an investment solution or let our questionnaire guide you.

Discover the option best suited to your objectives and needs.

Start your investing journey with our experts by your side.

Choose an investment solution or let our questionnaire guide you.

Discover the option best suited to your objectives and needs.

Start your investing journey with our experts by your side.