Lost a pension? We’ll find it for you with Find, Check & Transfer.

With our Find, Check & Transfer service, let us do all the hard work finding and combining your lost pensions into one simple plan.

Lost a pension? We’ll find it for you with Find, Check & Transfer.

With our Find, Check & Transfer service, let us do all the hard work finding and combining your lost pensions into one simple plan.

Get startedCombine pensionsGet a cash boost of up to £3,000 when you transfer your pensions.

Offer valid until December 2nd.

Capital at risk. UK residents, 18+. T&Cs apply.

What you get with Find, Check & Transfer.

Find, Check & Transfer.

We’ll do all the work for you – for free! We’ll look for lost pensions, check them for benefits or penalties, and then complete the transfer on your behalf.

Take back control of your pensions.

Combine your old or lost pensions into one simple plan and get all of your retirement wealth working hard again.

All your investments under one roof.

Enjoy the simplicity of all your retirement wealth in one place, with the potential to perform better and grow more efficiently over time.

What you get with Find, Check & Transfer.

We’ll do all the work for you – for free! We’ll look for lost pensions, check them for benefits or penalties, and then complete the transfer on your behalf.

Combine your old or lost pensions into one simple plan and get all of your retirement wealth working hard again.

Enjoy the simplicity of all your retirement wealth in one place, with the potential to perform better and grow more efficiently over time.

What to know before transferring a pension.

Rest assured, we’re committed to ensuring that your pension transfer experience is smooth, transparent, and meets your individual needs.

Get startedBefore transferring your pension, it’s important to make these checks:

Review fees and penalties.

Ensure you won't lose valuable guarantees like annuity rates, guaranteed income, or death benefits. Seek financial advice if unsure.

Check for guaranteed benefits.

Assess your current pension fees and check for any exit fees or transfer penalties from your existing provider.

Confirm eligibility.

Please note that we can’t transfer defined benefit schemes, replace your active workplace pension, or transfer pensions already paying out benefits.

What to know before transferring a pension.

Rest assured, we’re committed to ensuring that your pension transfer experience is smooth, transparent, and meets your individual needs.

Before transferring your pension, it’s important to make these checks:

Ensure you won't lose valuable guarantees like annuity rates, guaranteed income, or death benefits. Seek financial advice if unsure.

Assess your current pension fees and check for any exit fees or transfer penalties from your existing provider.

Please note that we can’t transfer defined benefit schemes, replace your active workplace pension, or transfer pensions already paying out benefits.

How our pricing works.

Choose an investment style and compare the fees.

Management fees are charged on your invested amount. You’ll also incur average fund costs (around 0.20% per year) and market spread effects (up to 0.09% per year).

Platform fee

(Min £1.25/month)

The platform fee applies to all Wealth assets combined. VAT included where applicable.

Calculate my feesGuidance that grows with you.

From digital advice to one-to-one support with a Dedicated Qualified Wealth Manager, our Wealth tiers are designed to give you the right level of guidance as your investment needs grow.

Discover the Wealth tiersDiscover the Wealth tiers

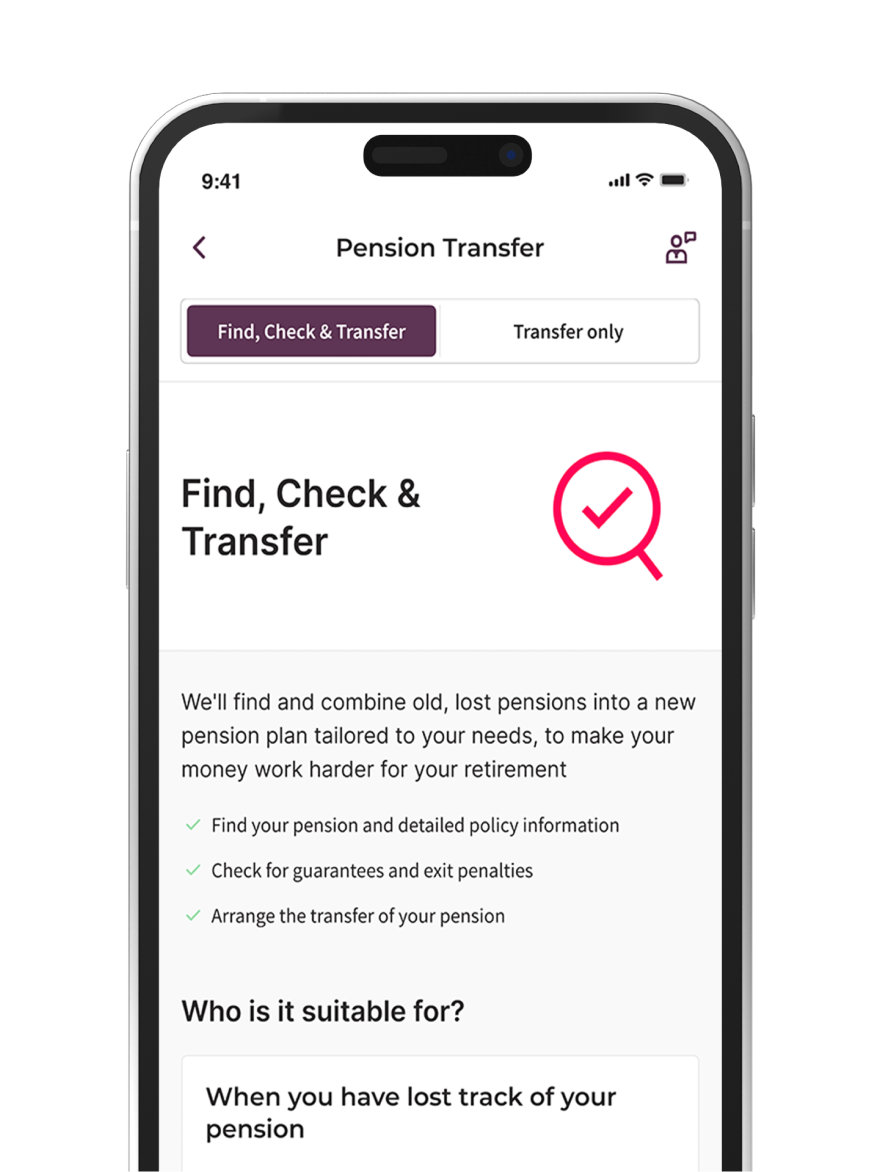

Start your pension journey in 3 simple steps.

On your own or with help from one of our consultants.

Choose our Find, Check & Transfer option or let our questionnaire guide you.

We’ll manage the entire process of finding and combining your pensions into one simple plan.

Start your pension investing journey with Moneyfarm, with all your retirement wealth under one roof.

Choose our Find, Check & Transfer option or let our questionnaire guide you.

We’ll manage the entire process of finding and combining your pensions into one simple plan.

Start your pension investing journey with Moneyfarm, with all your retirement wealth under one roof.