DIY Investing: Mutual funds.

Access a world of funds, managed by institutional investment professionals. Mutual funds provide an efficient gateway to a wide array of investments.

Get started

DIY Investing: Mutual funds.

Access a world of funds, managed by institutional investment professionals. Mutual funds provide an efficient gateway to a wide array of investments.

Get startedWhat are mutual funds?

Mutual funds are investment vehicles that pool money from many investors to purchase a diverse portfolio of securities. Key features include:

Professional management

Institutional fund managers make investment decisions on behalf of investors.

Diversification

Each fund typically holds a variety of stocks, bonds, or other securities.

Share classes

Funds often offer different share classes with varying fee structures.

Transparency

Mutual funds are subject to strict regulatory oversight to protect investors.

The benefits of mutual funds.

Instant diversification

Gain exposure to numerous securities through a single investment, spreading risk across various assets.

Institutional management

Benefit from the knowledge and experience of professional fund managers who actively research and select investments.

Accessibility

Start investing with relatively small amounts, making it easier for beginners to enter the market.

Cost-efficient

Access institutional-level investing power, potentially reducing transaction costs compared to individual investing.

Gain exposure to numerous securities through a single investment, spreading risk across various assets.

Benefit from the knowledge and experience of professional fund managers who actively research and select investments.

Start investing with relatively small amounts, making it easier for beginners to enter the market.

Access institutional-level investing power, potentially reducing transaction costs compared to individual investing.

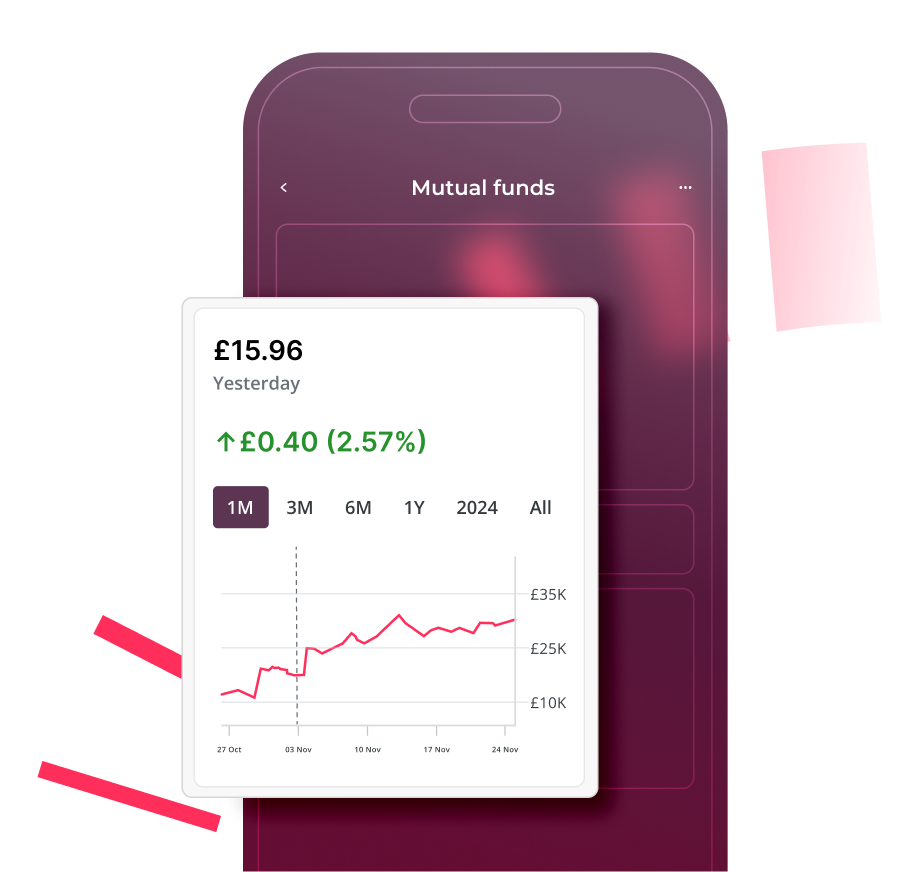

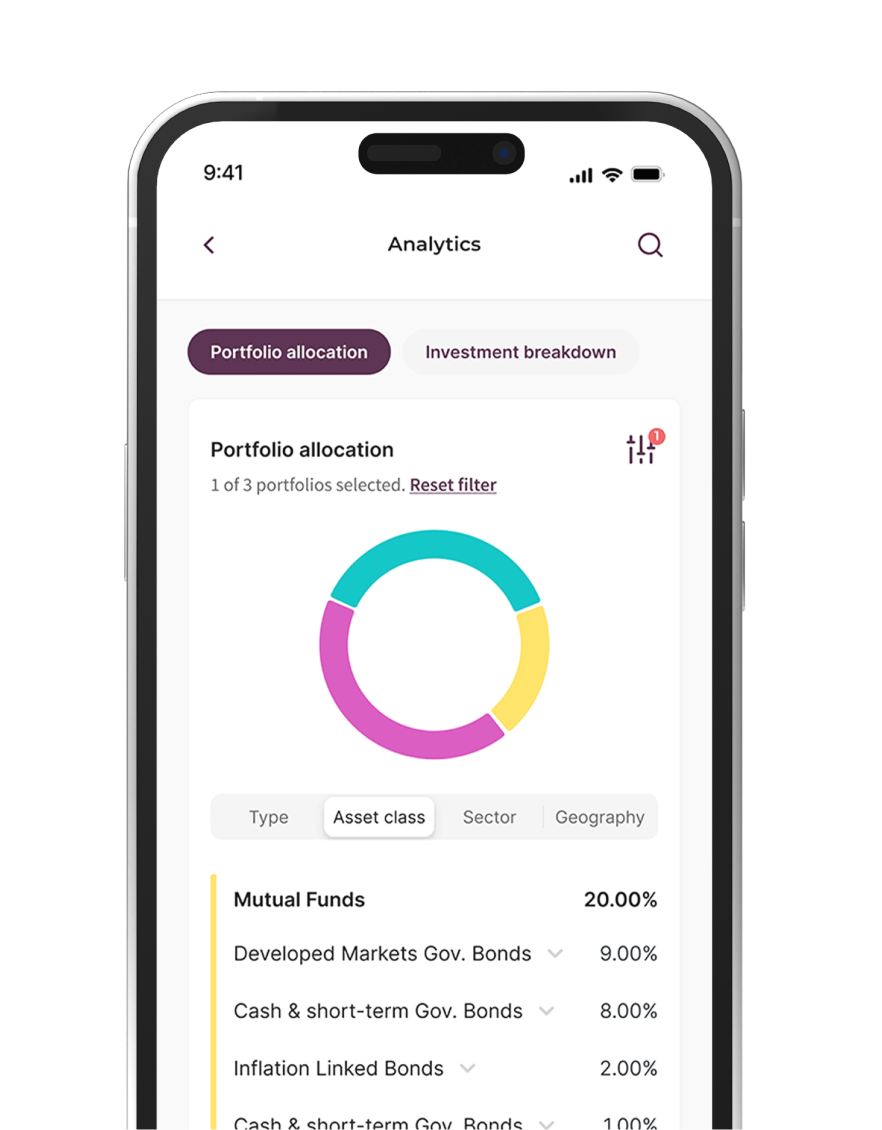

Deeper insight with Analytics.

Our Analytics feature provides you with real-time oversight of your portfolio’s global diversification. Maintain a comprehensive view of all your investments, whether they're managed by us or independently by you.

View how your investments are spread by Type, Asset Class, Sector, and Geography. Analytics offers a consolidated view of all your wealth, bringing greater clarity to your investing journey.

The benefits of DIY Investing.

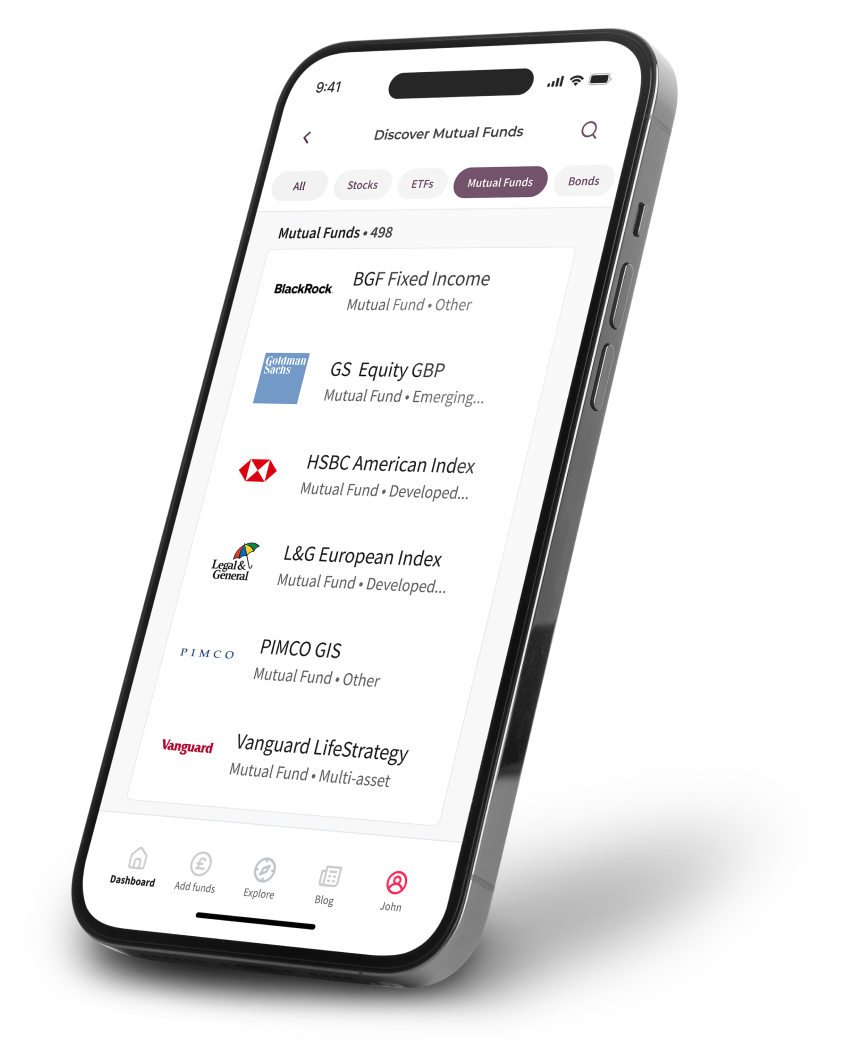

Direct market access

Access a diverse investment universe of 1,000+ individual stocks, ETFs, bonds, and mutual funds.

One home for all your investments

Build your own diverse portfolio or invest alongside our expertly managed, globally diversified options to take full advantage of our expertise.

Personalised strategy

Build a portfolio that truly reflects your values and wealth goals. Shape your investment journey, one carefully chosen asset at a time.

Access a diverse investment universe of 1,000+ individual stocks, ETFs, bonds, and mutual funds.

Build your own diverse portfolio or invest alongside our expertly managed, globally diversified options to take full advantage of our expertise.

Build a portfolio that truly reflects your values and wealth goals. Shape your investment journey, one carefully chosen asset at a time.

Get started in 3 simple steps.

Choose to invest your own way and let our questionnaire guide you.

Select your account type – Stocks and Shares ISA or General Investment Account – and fill in your details.

Start building your portfolio with access to our research tools and expert insights.

Choose to invest your own way and let our questionnaire guide you.

Select your account type – Stocks and Shares ISA or General Investment Account – and fill in your details.

Start building your portfolio with access to our research tools and expert insights.