DIY Investing: ETFs.

Exchange-traded funds (ETFs) offer a smart way to access a world of investments. Build a diverse portfolio, buy and sell efficiently, and benefit from lower costs.

Get started

DIY Investing: ETFs.

Exchange-traded funds (ETFs) offer a smart way to access a world of investments. Build a diverse portfolio, buy and sell efficiently, and benefit from lower costs.

Get startedWhat are ETFs?

Exchange-traded funds (ETFs) are investments that offer a unique way to access financial markets. Here’s what makes them stand out:

Basket of securities

Each ETF contains a collection of assets such as stocks, bonds, or commodities, allowing you to invest in multiple securities with a single purchase.

Index tracking

Many ETFs are designed to track the performance of a specific market index, providing broad market exposure efficiently.

Diversification

Invest in a range of assets or markets with just one ETF, helping to spread risk across multiple securities.

Each ETF contains a collection of assets such as stocks, bonds, or commodities, allowing you to invest in multiple securities with a single purchase.

Many ETFs are designed to track the performance of a specific market index, providing broad market exposure efficiently.

Invest in a range of assets or markets with just one ETF, helping to spread risk across multiple securities.

The benefits of ETFs.

High liquidity

As traded instruments, ETFs are highly liquid assets. This means you can easily buy or sell shares without significantly impacting their value.

Cost-efficient

Passive management makes ETF investing extremely cost-efficient. The management fee for an ETF rarely exceeds 0.5%, while that of an actively managed fund often surpasses 2%.

Accessibility

With ETFs, anyone can access major market indices without the need to purchase all the individual securities in the basket.

Security

The assets invested in ETFs are kept separate from those of the company managing their issuance and administration. This means your investment is protected even in the event of the company’s insolvency.

The benefits of ETFs.

As traded instruments, ETFs are highly liquid assets. This means you can easily buy or sell shares without significantly impacting their value.

Passive management makes ETF investing extremely cost-efficient. The management fee for an ETF rarely exceeds 0.5%, while that of an actively managed fund often surpasses 2%.

With ETFs, anyone can access major market indices without the need to purchase all the individual securities in the basket.

The assets invested in ETFs are kept separate from those of the company managing their issuance and administration. This means your investment is protected even in the event of the company’s insolvency.

What to know before transferring a pension.

Collections

Explore securities from specific geographic areas or sectors, allowing you to effortlessly discover promising investment opportunities. Our Curated Collections are carefully selected by our Asset Allocation team to offer you focused investment strategies through groups of themed ETFs, such as “AI Innovators” and “Fixed Income”.

Analytics

Use Analytics to gain deeper insight into your investments. View how your investments are spread by Type, Asset Class, Sector, and Geography. Analytics offers a consolidated view of all your wealth, bringing greater clarity to your investing journey.

Our Curated Collections.

High Dividend Yield

Boost your income potential with ETFs that target high-paying dividend stocks. These ETFs are carefully selected for their strong dividend distribution history, favourable trading costs, and large company sizes.

Fixed Income

Aim for consistent returns while managing interest rate sensitivity. This collection features bond ETFs offering competitive expected returns. We focus on large fund sizes, typically over $100 million, for stability.

AI Innovators

Tap into the exciting world of artificial intelligence. These ETFs have substantial fund sizes over $100 million, and they offer a solid entry point into the fast-growing AI sector, balancing innovation with established market presence.

Geopolitical Trends

Invest in sectors shaping today's global political landscape. Featuring ETFs with a minimum of 200 million dollars in assets, this curated selection provides targeted exposure to politically relevant industries, allowing you to align your investments with global trends.

The benefits of DIY Investing.

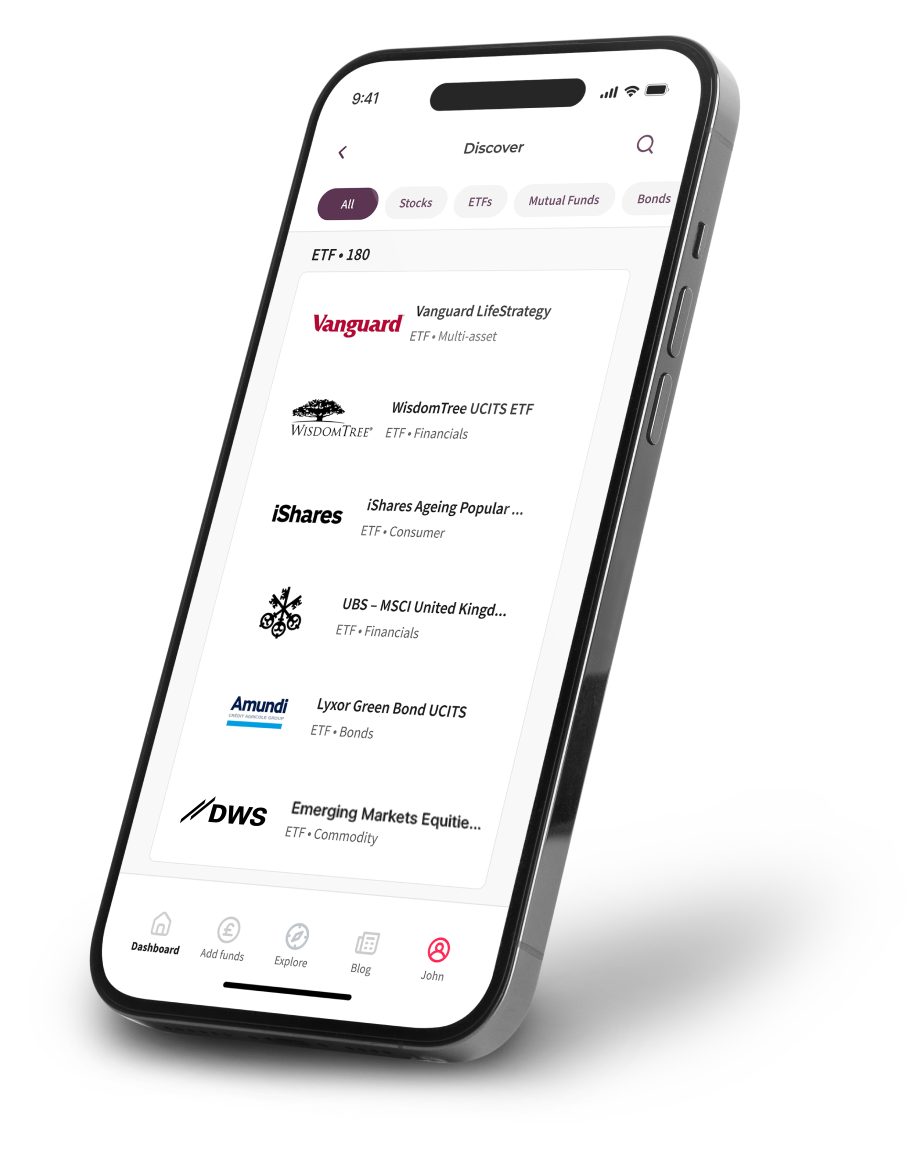

Direct market access

Access a diverse investment universe of 1,000+ individual stocks, ETFs, bonds, and mutual funds.

One home for all your investments

Build your own diverse portfolio or invest alongside our expertly managed, globally diversified options to take full advantage of our expertise.

Personalised strategy

Build a portfolio that truly reflects your values and wealth goals. Shape your investment journey, one carefully chosen asset at a time.

Access a diverse investment universe of 1,000+ individual stocks, ETFs, bonds, and mutual funds.

Build your own diverse portfolio or invest alongside our expertly managed, globally diversified options to take full advantage of our expertise.

Build a portfolio that truly reflects your values and wealth goals. Shape your investment journey, one carefully chosen asset at a time.

Get started in 3 simple steps.

Choose to invest your own way and let our questionnaire guide you.

Select your account type – Stocks and Shares ISA or General Investment Account – and fill in your details.

Start building your portfolio with access to our research tools and expert insights.

Choose to invest your own way and let our questionnaire guide you.

Select your account type – Stocks and Shares ISA or General Investment Account – and fill in your details.

Start building your portfolio with access to our research tools and expert insights.