DIY Investing: Bonds.

Discover how bonds can provide steady income and balance to your investment strategy. Whether you’re looking to diversify, generate reliable cash flow, or reduce overall portfolio risk, bonds offer unique advantages for investors of all types.

Get started

DIY Investing: Bonds.

Discover how bonds can provide steady income and balance to your investment strategy. Whether you’re looking to diversify, generate reliable cash flow, or reduce overall portfolio risk, bonds offer unique advantages for investors of all types.

Get startedWhat are bonds?

Bonds are debt securities issued by governments, municipalities, or corporations to raise capital. When you buy a bond, you’re essentially lending money to the issuer. Key features of bonds include:

Fixed term

Bonds have a predetermined lifespan, known as the maturity date.

Face value

The principal amount that will be repaid at maturity.

Interest payments

Most bonds provide regular interest payments, called coupons.

Credit ratings

Bonds are rated based on the issuer's creditworthiness, affecting their risk and yield.

Types

Available in various forms, including government, corporate, and municipal bonds.

The benefits of bonds.

Steady income stream

Bonds typically offer regular interest payments, providing a reliable source of income for investors.

Stability

Bonds can help smooth out portfolio performance during stock market declines, enhancing overall diversification.

Wealth preservation

Bonds are generally less risky than stocks, offering better protection of your principal investment, especially government bonds.

Short-term investing

Bond interest rates often exceed traditional savings account rates, offering better growth potential for your short-term savings.

Bonds typically offer regular interest payments, providing a reliable source of income for investors.

Bonds can help smooth out portfolio performance during stock market declines, enhancing overall diversification.

Bonds are generally less risky than stocks, offering better protection of your principal investment, especially government bonds.

Bond interest rates often exceed traditional savings account rates, offering better growth potential for your short-term savings.

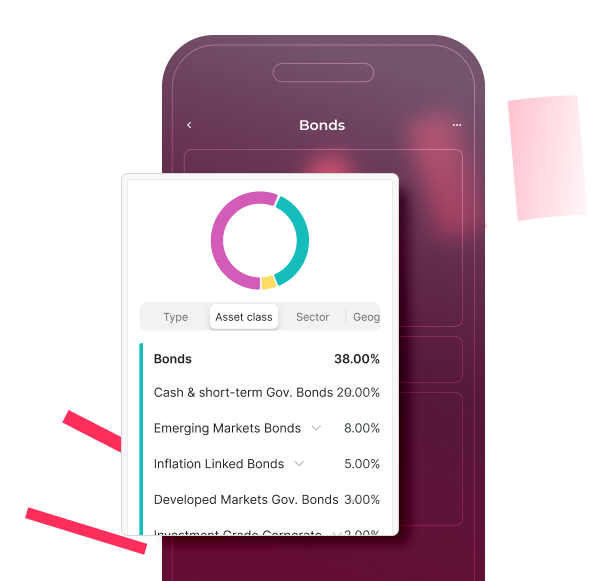

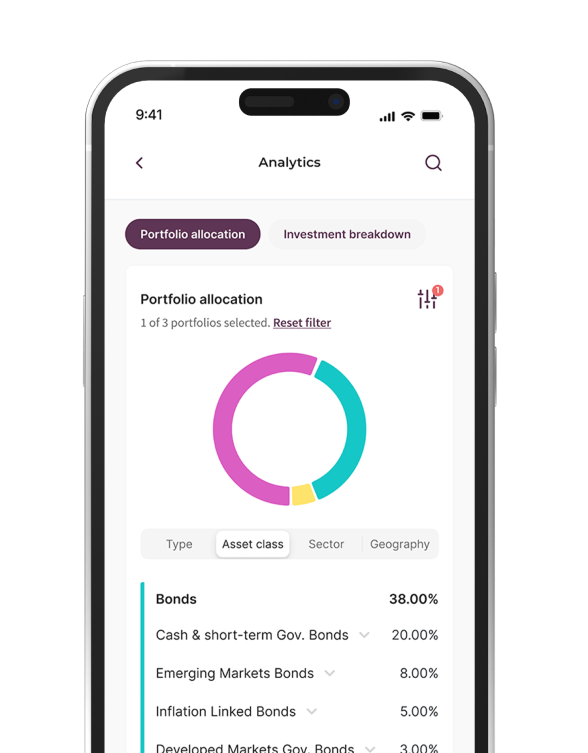

Deeper insight with Analytics.

Our Analytics feature provides you with real-time oversight of your portfolio’s global diversification. Maintain a comprehensive view of all your investments, whether they're managed by us or independently by you.

View how your investments are spread by Type, Asset Class, Sector, and Geography. Analytics offers a consolidated view of all your wealth, bringing greater clarity to your investing journey.

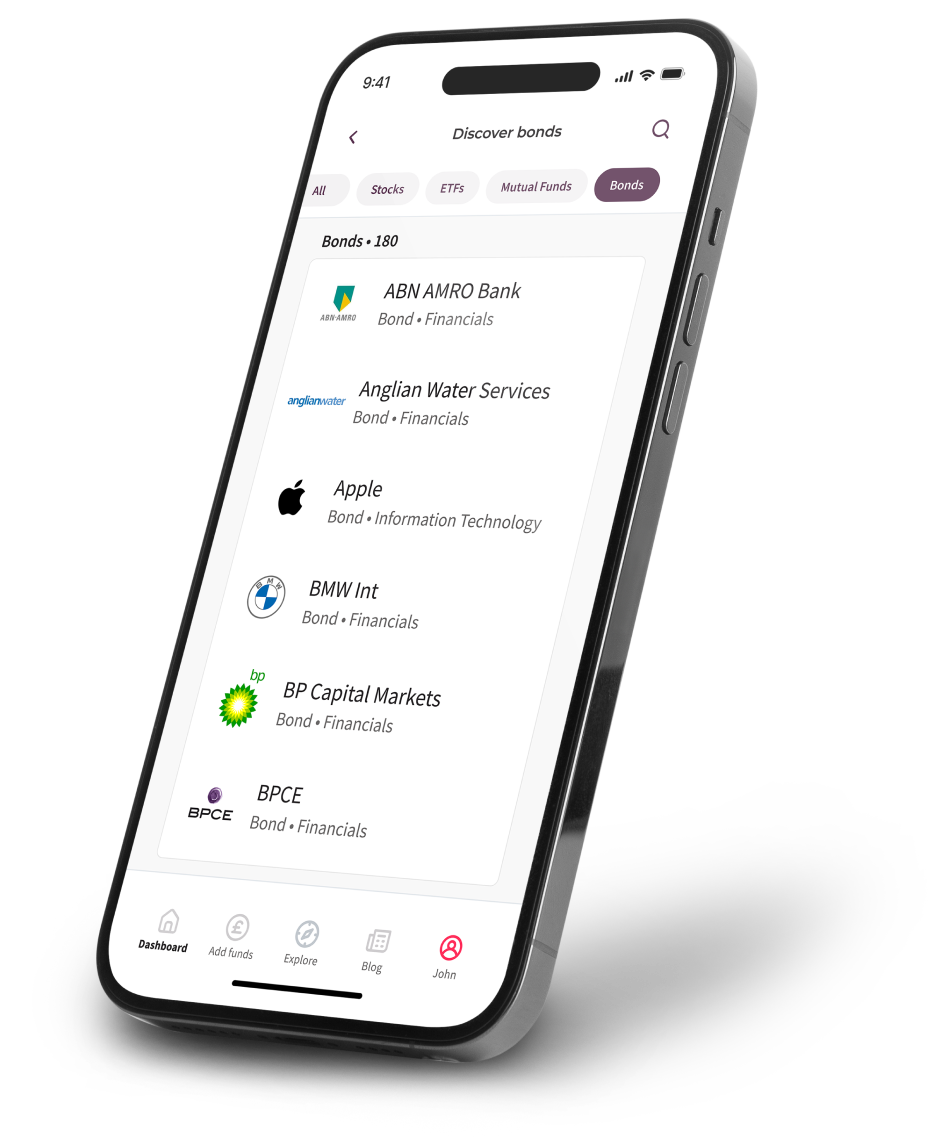

The benefits of DIY Investing.

Direct market access

Access a diverse investment universe of 1,000+ individual stocks, ETFs, bonds, and mutual funds.

One home for all your investments

Build your own diverse portfolio or invest alongside our expertly managed, globally diversified options to take full advantage of our expertise.

Personalised strategy

Build a portfolio that truly reflects your values and wealth goals. Shape your investment journey, one carefully chosen asset at a time.

Access a diverse investment universe of 1,000+ individual stocks, ETFs, bonds, and mutual funds.

Build your own diverse portfolio or invest alongside our expertly managed, globally diversified options to take full advantage of our expertise.

Build a portfolio that truly reflects your values and wealth goals. Shape your investment journey, one carefully chosen asset at a time.

Get started in 3 simple steps.

Choose to invest your own way and let our questionnaire guide you.

Select your account type – Stocks and Shares ISA or General Investment Account – and fill in your details.

Start building your portfolio with access to our research tools and expert insights.

Choose to invest your own way and let our questionnaire guide you.

Select your account type – Stocks and Shares ISA or General Investment Account – and fill in your details.

Start building your portfolio with access to our research tools and expert insights.