Simplify your retirement wealth: Transfer a pension to Moneyfarm.

Everything you need to know about transferring and consolidating your pensions. Understand the benefits, weigh up your options and make informed decisions with Moneyfarm at your side.

Check your existing pension for any guaranteed benefits or penalties before you transfer.

Simplify your retirement wealth: Transfer a pension to Moneyfarm.

Everything you need to know about transferring and consolidating your pensions. Understand the benefits, weigh up your options and make informed decisions with Moneyfarm at your side.

Check your existing pension for any guaranteed benefits or penalties before you transfer.

Transfer a pensionBook appointmentGet a cash boost of up to £3,000 when you transfer your pensions.

Offer valid until December 2nd.

Capital at risk. UK residents, 18+. T&Cs apply.

The benefits of pension consolidation.

Save money on fees

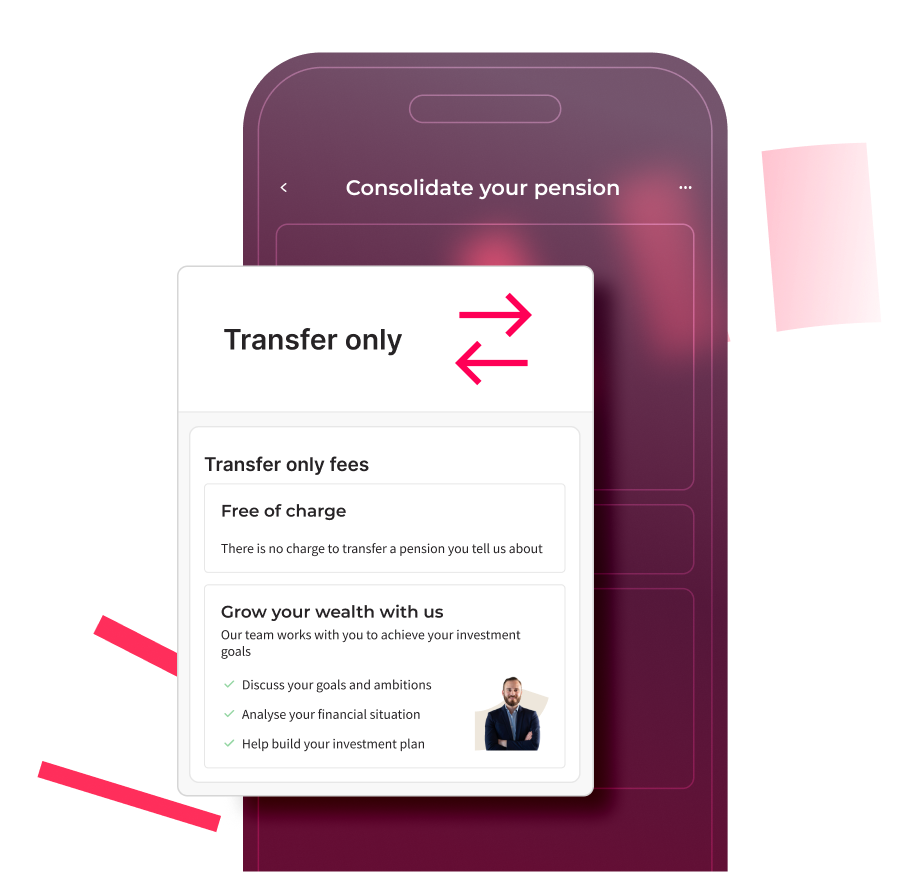

If you have multiple pensions, you could be paying more fees than you should be. By combining your pensions into one plan with Moneyfarm, you could save money on fees. Plus, transfers are free.

Keep on track of your pension performance

Is your workplace pension ideal for your unique situation? At Moneyfarm, we make sure it’s matched to your needs and goals. Plus, our app gives you simpler tracking and the freedom to monitor your performance 24/7.

Flexibility, choice and guidance

With Moneyfarm, our pension offers you flexibility and the freedom to choose how you access your retirement wealth. Plus, our investment consultants are on hand to provide guidance and help you make informed decisions about your pension.

Expertly managed for optimal performance

Our investment professionals actively manage your pension using data-driven strategies. We aim to optimise returns while managing risk, potentially boosting the long-term performance of your retirement wealth.

The benefits of pension consolidation.

If you have multiple pensions, you could be paying more fees than you should be. By combining your pensions into one plan with Moneyfarm, you could save money on fees. Plus, transfers are free.

Is your workplace pension ideal for your unique situation? At Moneyfarm, we make sure it’s matched to your needs and goals. Plus, our app gives you simpler tracking and the freedom to monitor your performance 24/7.

With Moneyfarm, our pension offers you flexibility and the freedom to choose how you access your retirement wealth. Plus, our investment consultants are on hand to provide guidance and help you make informed decisions about your pension.

Our investment professionals actively manage your pension using data-driven strategies. We aim to optimise returns while managing risk, potentially boosting the long-term performance of your retirement wealth.

All your pension wealth under one roof.

In the UK there are 2.8 million unclaimed pension pots worth a combined £26.6 billion. It’s estimated that one in four people have lost track of at least one pension. Are you one of them?

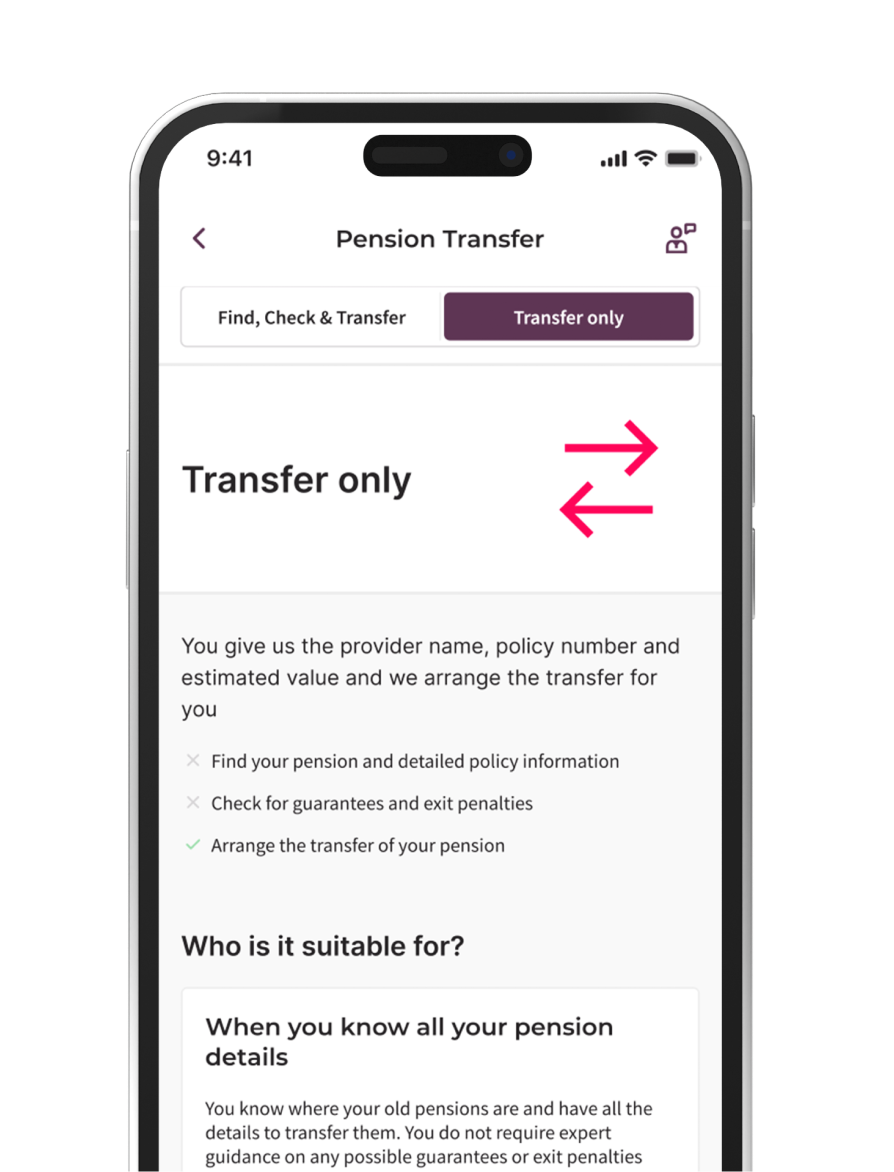

At Moneyfarm, we offer a hassle-free transfer service to consolidate your pensions and bring them all under one roof, making tracking and planning your retirement easier than ever.

We’ll get you set up with a pension suited to you, based on your goals and attitude to risk. We offer simplicity, 24/7 access to your account, and expert guidance from our consultants at any point.

What to know before transferring a pension.

Rest assured, we’re committed to ensuring that your pension transfer experience is smooth, transparent, and meets your individual needs.

Get startedBefore transferring your pension, it’s important to make these checks:

Review fees and penalties.

Ensure you won't lose valuable guarantees like annuity rates, guaranteed income, or death benefits. Seek financial advice if unsure.

Check for guaranteed benefits.

Assess your current pension fees and check for any exit fees or transfer penalties from your existing provider.

Confirm eligibility.

Please note that we can’t transfer defined benefit schemes, replace your active workplace pension, or transfer pensions already paying out benefits.

What to know before transferring a pension.

Rest assured, we’re committed to ensuring that your pension transfer experience is smooth, transparent, and meets your individual needs.

Before transferring your pension, it’s important to make these checks:

Ensure you won't lose valuable guarantees like annuity rates, guaranteed income, or death benefits. Seek financial advice if unsure.

Assess your current pension fees and check for any exit fees or transfer penalties from your existing provider.

Please note that we can’t transfer defined benefit schemes, replace your active workplace pension, or transfer pensions already paying out benefits.

Start your pension journey in 3 simple steps.

On your own or with help from one of our consultants.

Choose our pension or let our questionnaire guide you.

Discover your investor profile based on your needs and goals.

Start your pension investing journey with our experts by your side.

Choose our pension or let our questionnaire guide you.

Discover your investor profile based on your needs and goals.

Start your pension investing journey with our experts by your side.